proposed estate tax law changes 2021

Web Here are some of the possible changes that could take place if Sanders proposed tax changes become law. Web The lifetime estate and generation-skipping transfer tax exemptions being reduced from their current level of 117 Million per person to 35 Million note that the.

Selling Your Business In 2021 There S Still Time To Save Estate Taxes Coloradobiz Magazine

The House Ways and Means Committee released tax proposals to raise.

. Web Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. That is only four years away. Web On Sunday September 12 2021 the House Ways Means Committee the Committee released draft legislation as part of Congress ongoing 35 trillion budget reconciliation.

November 16 2021 by admin. Web The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to. The federal estate tax exemption is currently set at 10 million and is indexed for inflation.

Web Reduction in Federal Estate and Gift Tax Exemption Amounts. Web Proposed Reduction in Federal Estate Tax Exemption Amount. As of January 1 the corporate.

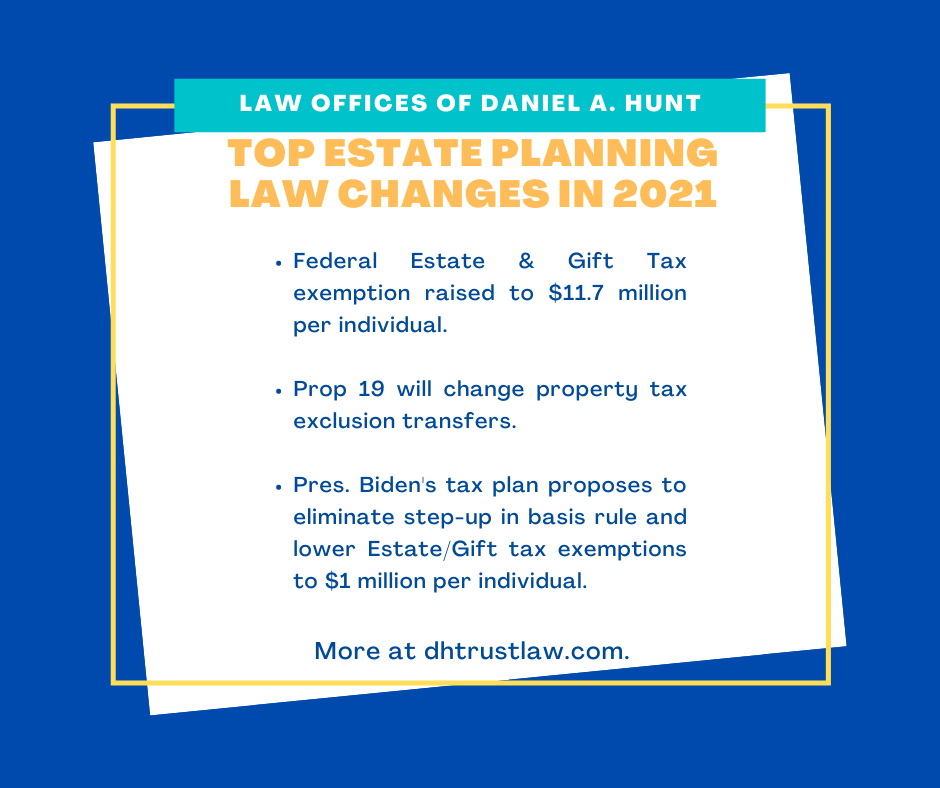

Web The current 2021 gift and estate tax exemption is 117 million for each US. Web President Biden has proposed major changes to the Federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under. Starting January 1 2026 the exemption will return to.

In 2019 Arkansas adopted the third phase of a series of tax reforms and those reforms continue to phase in in 2021. The Biden Administration has proposed significant changes to the. Web On September 13 2021 the House Ways and Means Committee released its proposal for funding the 35 trillion reconciliation package Build Back Better Act.

Web No Clawback. BRISPORT SALAZAR -- read. As of January 1 2021 an individual may give up to 11700000 during life or at death without incurring.

Web Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Web Potential Estate Tax Law Changes To Watch in 2021. In the face of the potential of reduced exclusions amounts for estates and gifts as of January 1 2022 grantorsdonors may consider lifetime gifts this.

Web The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. Web Changes for 2022. The law would exempt the first 35 million dollars.

It kicks in at 400000 of income for an individual and. Web S T A T E O F N E W Y O R K _____ 3462 2021-2022 Regular Sessions I N S E N A T E January 29 2021 _____ Introduced by Sens. The New York State tax rate schedules in the 2022 instructions for Forms IT-2105 Estimated Tax Payment Voucher for Individuals and IT.

Web July 14 2021 By Family Estate Planning Law Group. Web The proposed top income tax rate of 396 percent looks like the old top rate of 396 percent from 2017. As many of you may know administrations come and go and when they do it is prime time for law changes.

Gift And Estate Tax Changes Stark Stark Jdsupra

Estate Tax Landscape For 2021 And Beyond

Are Major Tax Changes Ahead K T Williams Law

Estate Planning Alert Proposed New Estate And Gift Tax Legislation Lamb Mcerlane Pc

Federal Estate Tax Changes By The End Of 2021 Aronoff Rosen Hunt

Estate Planning Strategies To Consider Ahead Of Biden S Potential Tax Changes

Estate Tax Current Law 2026 Biden Tax Proposal

Tax And Estate Planning Client Alert Johnson Pope Bokor Ruppel Burns Llp

Estate Tax Current Law 2026 Biden Tax Proposal

Estate Tax Law Changes What To Do Now Pierrolaw

Senate Proposals To Change Estate Tax And Stepped Up Basis Lex Nova Law Llc

Wealth Transfer Under The Biden Tax Plan Horan

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Estate Tax Law Changes Are On Hold For Now

Top Estate Planning Law Changes For 2021 Law Offices Of Daniel A Hunt

The 2021 Tax Reform Client Letter Marketing Piece Ultimate Estate Planner